Cars and truck insurance coverage deductibles function continually with the various kinds of automobile insurance coverage you may buy for your cars and truck. There are also some insurance coverage types (like responsibility) that an insurance deductible might not relate to - car insurance. At the very same time, you're likewise able to personalize your deductible total up to better suit your car insurance budget.

There are a pair of essential things you must understand prior to deciding just how much you need to set your vehicle insurance deductible amount for. We'll discuss what your deductibles can apply to as well as exactly how they can impact your cars and truck insurance all at once. Consider all that follows your personal guide to auto insurance policy deductibles (cars).

Naturally, there's responsibility insurance which most states require their motorists to lug in the event they create an additional driver physical damage or vehicle damage. Cars and truck insurance coverage deductibles won't use to harm that you created to another driver.

cheap insurers low cost auto

cheap insurers low cost auto

These actually could be needed in some states., as the name suggests, covers you should you be struck by a chauffeur with no automobile insurance coverage to cover the problems.

The Ultimate Guide To Car Insurance Deductibles: Choosing Well - State Farm

Auto Insurance Policy Deductible Amount, A vehicle insurance policyholder has the ability to set their insurance deductible limitation when getting a new policy. Vehicle drivers can establish their vehicle deductibles anywhere in between $100 to $2,500. The nationwide standard is $500. There's no wrong solution for just how a lot an insurance deductible can be. As an example, allow's claim that you pick $500 as your deductible quantity.

affordable car insurance vehicle low cost auto cheap insurance

affordable car insurance vehicle low cost auto cheap insurance

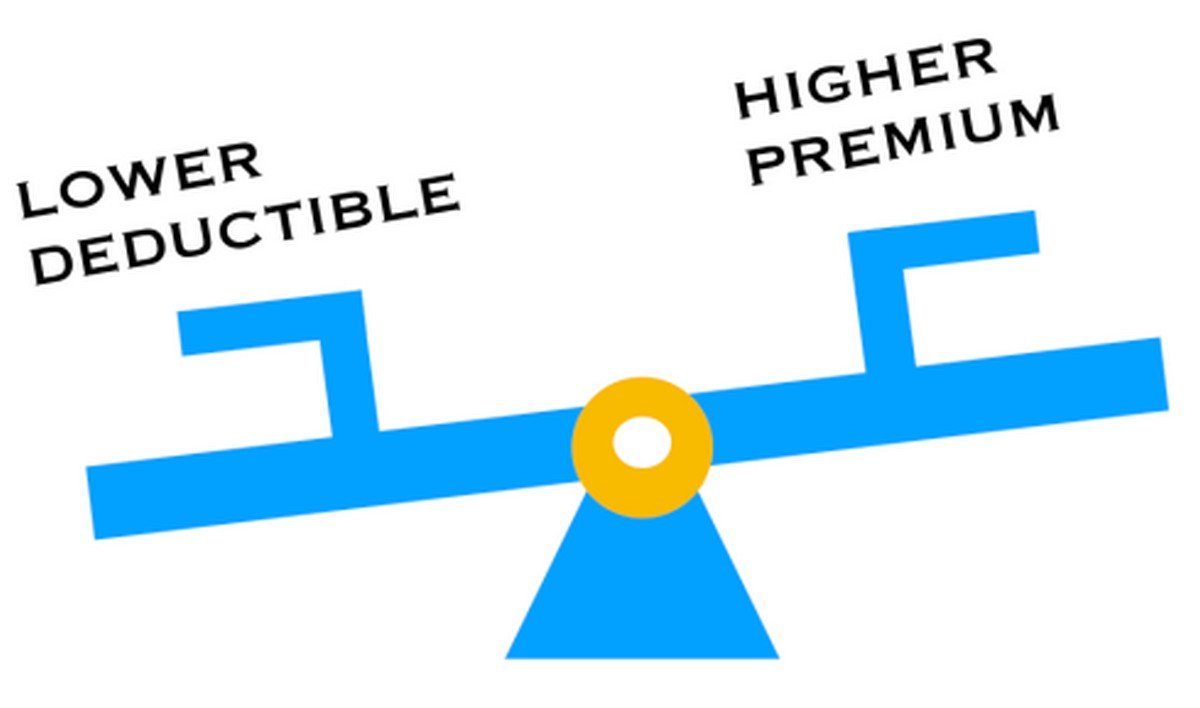

Deductibles Influence Just How Much You Pay For Car Insurance Coverage, This is just the price of your deductibles. A greater vehicle deductible restriction can result in lower costs, while a reduced deductible restriction can increase your regular monthly premiums and the overall expense of cars and truck insurance.

Currently, let's claim that you enhance your deductible to $250. A deductible limitation of $500 would result in lower month-to-month car prices of $129 (low cost auto).

Like, upping your insurance deductible from $1,000 to $2,000 might just conserve you around 6%, while $500 to $1,000 can conserve you as much as 40%. There are some deductibles that aren't worth it. When is an Automobile Insurance Coverage Deductible Paid? What figures out whether or not you'll need to pay a deductible is the condition of the car damages and what vehicle insurance coverage strategy you utilize to cover it - dui.

Not known Details About Who Pays The Deductible In A Michigan Car Accident?

Nonetheless, what does allow you to pay deductibles prior to the cars and truck insurance firm covers the repair service costs are: - Responsibility insurance coverage won't enable a deductible for fixings to damages suffered in an accident that was the mistake of one more chauffeur. Currently, if you were at fault for the crash as well as damages, after that harms to your vehicle would be covered by your collision plan, which permits deductible use.

After submitting the vehicle case, you would certainly have the ability to pay your insurance deductible. - In no-fault states, whoever created the mishap in the initial location isn't vital as well as needs vehicle drivers to bring no-fault or individual defense auto insurance coverage. This covers injuries and damages to your cars and truck. You pay the personal defense insurance deductible when you submit your car insurance claim.

The other driver would cover you. If your damage surpasses their own car insurance policy protection limits, you may be able to pay a deductible in the direction of it. When Isn't a Car Insurance Coverage Deductible Paid? Paying a deductible is essential for two out of the 3 strategies for complete vehicle insurance coverage accident and also detailed.

Possibly you do not desire the insurance deductible quantity deducted from your insurance payment (prices). If that holds true, here are a number of methods you can avoid paying your deductible if undesirable: - As stressed throughout, if you are struck by another motorist, then their responsibility cars and truck insurance policy would cover the costs of your repairs as well as injuries.

Some Known Details About Automobile Insurance - Nc.gov

- In a scenario where you have to pay your insurance deductible yet don't desire to, you may have the ability to exercise something with the auto mechanic. They would bill your automobile insurance provider sans the insurance deductible amount while you set up a payment strategy. The technician may hold your car until the deductible is paid. insure.

- While it varies with auto insurance provider, you may have the ability to forgo your insurance deductible when you submit a claim. The technician or vehicle shop will certainly charge your insurer without the deductible. This is much a lot more common with reduced deductibles like $250 and also $500. A $1,000 deductible would be nearly difficult for an auto store or vehicle insurer to forgo (auto).

Rather of changing them, they repair them, considered that the damage isn't also severe. You will more info not need to pay an insurance deductible to your cars and truck insurance service provider. Finest Technique For Setting Your Deductible, When deciding on what your auto deductible amount should be if you ever need to file a case, there are several aspects to think around - business insurance.

At the very same time, it assists to think of what your individual spending plan enables. Below's what you should consider concerning your auto insurance coverage when setting your deductible limitation: - A car deductible is paid by the insurance policy holder out of pocket. insure. Start by asking yourself if you're able to pay $500 or $1,000 at any kind of given minute considering that accidents do occur.

The Ultimate Guide To 5 Ways To Keep Your Car Insurance Costs Down - Consumer ...

- With your deductible, believe regarding just how much your car insurance coverage company will payment after you submit your insurance claim. Would certainly a higher monthly vehicle costs be worth the reduced insurance deductible, or vice versa? - If an additional vehicle driver (with vehicle insurance policy) is accountable for any kind of problems, then you don't have to pay the deductible because it's the other motorist's insurance coverage covering it.

The monthly costs might be a little much, however that suggests that the deductible is low. A lot of vehicle drivers of rented cars and trucks pick reduced deductibles that offer even more protection (insure).

They're able to establish their collision insurance deductible lower or greater than their thorough insurance deductible - cheap car insurance. Vanishing Deductible Discount, A disappearing insurance deductible is a protection choice where the insurance policy holders pay a cost for reduced deductibles whenever a case is submitted.

At the very same time, it's straight proportional to your month-to-month rates. There are also a number of ways you can save money on those prices by going shopping around or bundling various other types of insurance with a specific firm. While it is a good suggestion to lower your insurance deductible if you desire more protection, it's not the very best strategy to increase them if you desire your car protection to be less expensive.

Excitement About Insurance Requirements - Virginia Dmv

Negative driversyou see them on a daily basis. The person that's paying even more focus to his cell phone than the road, the woman that reduces you off without looking, the teenager who's adjusting the radio dial. You may not be able to prevent them, however you shouldn't need to spend for their poor driving.

liability insurance companies auto insurance affordable auto insurance

liability insurance companies auto insurance affordable auto insurance

If the crash is the mistake of the various other chauffeur, we will certainly place a Repayment Recovery Examiner on the instance who will certainly make sure that the other driver, or his or her insurance provider, pays for the car relevant damages. And also, the inspector will certainly keep you educated regarding the settlement recuperation procedure - car insurance.

In some circumstances, no issue how tenacious we are, we can not recover the sum total we ask for. (In some cases this happens due to the fact that the various other celebration involved conflicts the reason of the mishap or does not have insurance policy. cheapest auto insurance.) We can not guarantee healing of your full deductible, however rest guaranteed that we make every effort to obtain you the optimum feasible reimbursement.

If the other parties entailed are uncooperative, healing could take longer or we may not be able to recoup anything at all. No issue what takes place, we can ensure one thing: We will work as difficult as possible, as long as possible on your behalf - cheap insurance.

Get This Report on When Not To File An Insurance Claim - Usa Today

Just how can I assist speed the settlement healing process? If you have an insurance policy case in repayment recuperation, one of the most vital thing to keep in mind is this: Allow us handle it! You can help us out by complying with these guidelines: Refer any type of inquiries from the various other parties entailed to the GEICO agent managing your insurance claim.

States have different rules pertaining to payment recovery, as well as some states do not permit settlement healing for some protections. Examine with the GEICO agent managing your claim if you would certainly such as even more info. This material is meant for general information only. It does not increase protection beyond the policy agreement. Please refer to your plan contract for any type of particular information or concerns on applicability of insurance coverage.

For the liability part of your auto insurance coverage policy, which covers the prices to fix any damages to another driver's car, there is no insurance deductible on your cars and truck insurance policy when you're at mistake in an accident (insurance companies). Almost all states call for motorists to bring liability insurance coverage.

The nationwide ordinary saving on premiums was 15 percent. The survey discovered that consumers in South Dakota can save a monstrous 28 percent, while customers in North Carolina saw the smallest cost savings, just regarding 6 percent.

How Find Out About Payment Recovery For Car Accidents - Geico can Save You Time, Stress, and Money.

Consider each insurance deductible separately, and also take into consideration establishing various deductibles for your vehicle insurance coverage thorough deductible and your accident insurance deductible. You may look at minimizing your comprehensive deductible given that it accounts for a smaller section of the total costs. That suggests you won't conserve much money if you enhance this insurance deductible. insurance.

Despite the fact that your deductible doesn't reset yearly, you would certainly still require to pay an insurance deductible each time you make a case. Some insurers will certainly lower your insurance deductible for every year you don't have an accident. What you may not see is that these "financial savings" are pumping up the price of your costs.

suvs prices cheap auto insurance insurance company

suvs prices cheap auto insurance insurance company

If it just takes a couple of months or a year, you can reserve enough to pay your costs, and after that start banking the rest. Paying an insurance deductible can suggest having to cough up a significant chunk of modification. If you're fretted that you can not pay for ahead up with enough cash money to pay your deductible, you have a couple of choices.

When you're attempting to identify just how much your insurance deductible ought to be for vehicle insurance, ask your insurance company about what their process is for accumulating deductibles, as well as how long it might consider you to receive a payout (prices). Below's what you can normally anticipate in a few various scenarios. First, your insurance firm needs to authorize the case in order for you to obtain a payment.

The Best Strategy To Use For Collision Protection - Mercury Insurance

When the quantity of your damages reaches your insurance deductible, the insurance provider will certainly release a payment for any type of repair work costs over and also over that amount When you get involved in a mishap with one more automobile, the insurer involved will certainly carry out an examination into which driver was at mistake to identify that pays the vehicle insurance policy deductible.